+

QuickFee Fee Funding

QuickFee is working together with Aon to Help Accounting Firms Reduce Risk and Improve Cash Flow

Get Started Now!

Gain VIP access to the same fee funding solution the top-tier accounting firms have

Discover an easier way to get paid. Using QuickFee, you can spend less time worrying about chasing payments and more time on client work.

- Ease your clients cash flow.

- No cost to your firm.

- Get paid 100% of your fees within your terms.

- Reduce collection admnistration.

- Fast approval and settlement.

- Allow clients to easily access financing, with a choice of monthly payments between 3 and 12 months.

Trusted service provider to accounting firms

We help you get paid faster

Easy online payment gateway

Integration with Xero

QuickFee + Aon

QuickFee is working together with Aon to Help CPA Firms Reduce Risk and Improve Cash Flow

QuickFee is now working with leading global professional services firm Aon to offer the fee funding solution to SME accounting clients.

There is a clear synergy between QuickFee’s and AON’s missions.

Accounting firms will always need professional indemnity insurance and cyber protection – and as their clients are impacted by high interest rates and inflation, firms may need additional help to keep cash flow steady. This is an opportunity to provide added value and meet clients’ most pressing needs.

In uncertain times, Accounting firms must be able to assist their clients with financial challenges, without putting the firm’s operations at risk. For this reason, we are thrilled to partner with Aon and offer an effective combination of professional risk and cash flow solutions for CPA firms. This in turn will allow them to better support their clients and contribute to long-term growth.

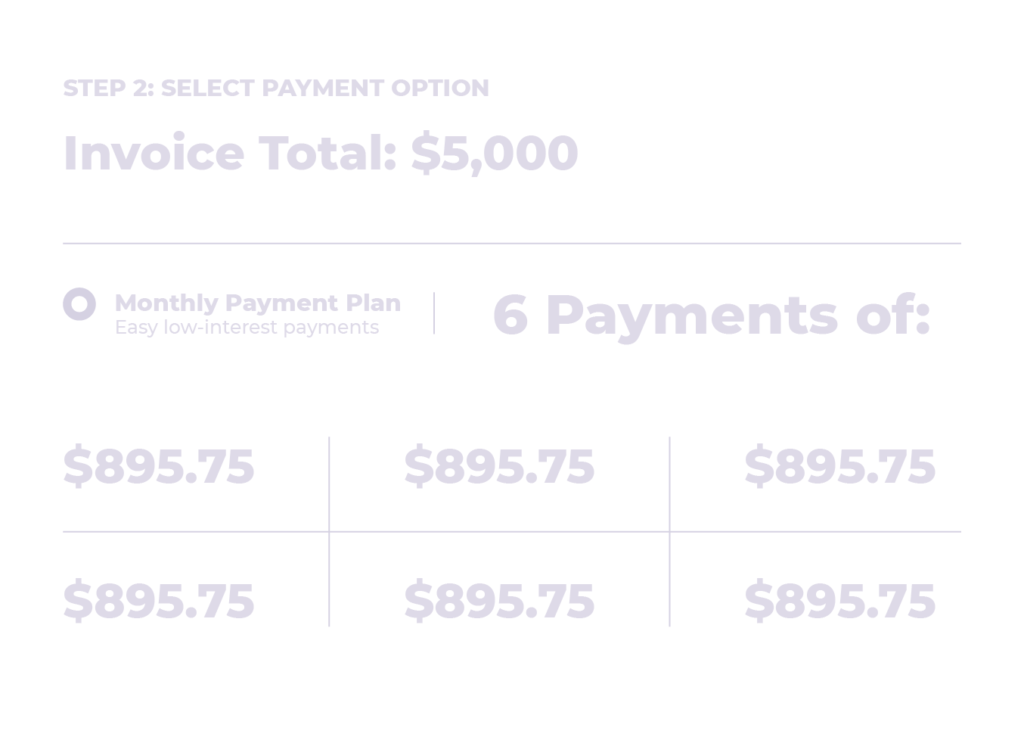

QuickFee Fee Funding Option

Delight customers with payment financing flexibility.

QuickFee Fee Funding is an easy way to take control of your operational costs, while helping customers manage their own expenses. Just send a payment plan quote anytime to make your services more affordable.

Best of all? Your business will always get paid in full and upfront.

Enquire about our Xero Integration

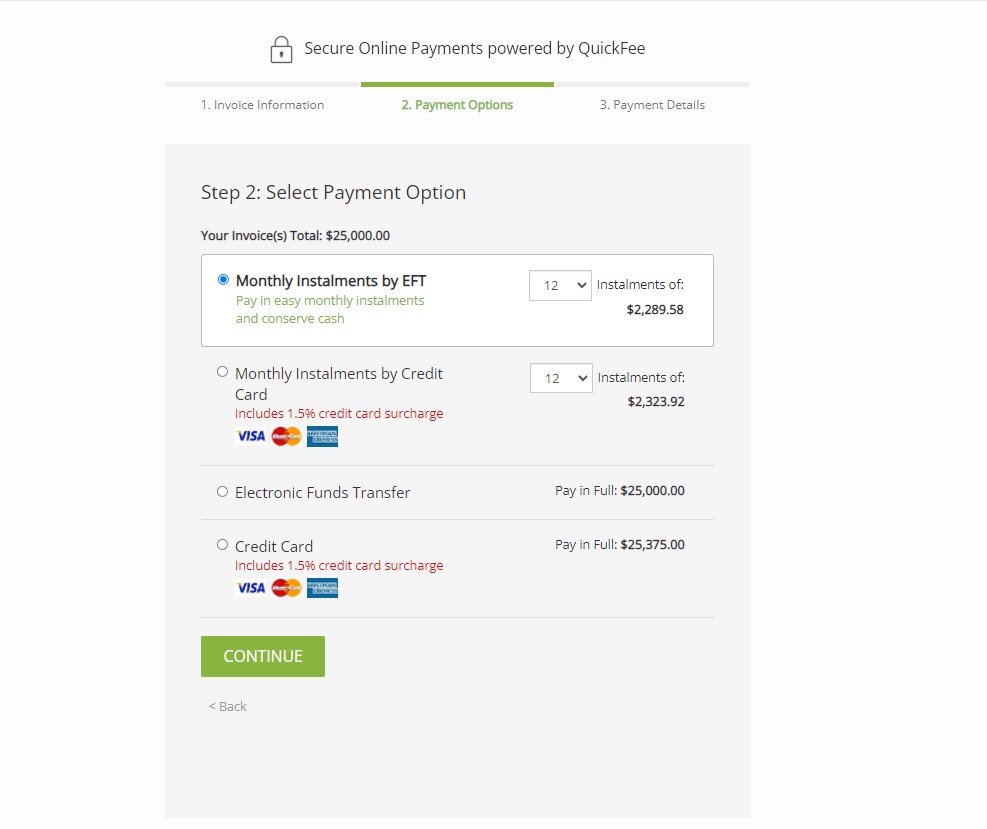

A beautiful payment experience for your clients and firm.

Key Benefits:

Smooth over your cash flow. Get paid upfront every time when customers can choose low-interest financing.

Spend less on collections.

It shouldn’t take months to get paid for your work. Cut down on collections with payment plans.

Close faster with prospects. With access to funding, customers are more likely to buy all the services they need.

Secure, reliable funding.

All payment plans go through a secure payment portal where you can review and approve.

Trusted for financing solutions since 2009:

Service providers worldwide

Average reduction in overdue payments

Funded for customers

You're in good company.

Already trusted and utilised successfully by top tier professional firms, thousands of service providers use QuickFee to get paid faster.

Using QuickFee enables you to streamline your payment processes from preparing contracts right through to processing payment instalments.

Simple setup.

You’ll get your payment portal ready within 1 or 2 business days.

Security first.

Protect yourself and your customers with a reliable, PCI compliant payment gateway.

Get paid anytime.

Customers can pay 24/7 through one online payment link.

Touchless transactions.

Just add your payment portal link to your emails, website or invoices.

Easy integrations.

It only takes a few clicks to integrate with your practice management system.

Here’s what our customers say:

Here’s what our customers say:

Read our case study to see how QuickFee helps accounting firms increase cash flow.

Customer-centered convenience that works with your process.

Amazing things happen when your payment process puts customers first. By providing easy access to financing to your clients, you’ll get paid faster, reduce collections and improve your cash flow over time. (You’ll also spend less time on manual data entry.)

A robust payment platform for every need.

Thousands of small businesses and professional service providers use QuickFee to offer convenience, cut costs, and simplify their workflow.

The QuickFee payment portal can be customised to meet the needs of your firm and your clients.

How does it work?

After signing up, you’ll get a custom payment portal to share with your customers.

Our payment solution experts will walk you through best practices and get you started.

Accept payments via your website, invoices, emails, etc.

A strong support team for payment plans:

+ Dedicated QuickFee specialist to help you generate payment plan quotes, reach out to late payers, or answer questions

+ Complete starter kit with marketing materials and resources

+ No additional time, costs, or setup to start offering payment plans